How to Create a Winning Prices Strategy for Your Business

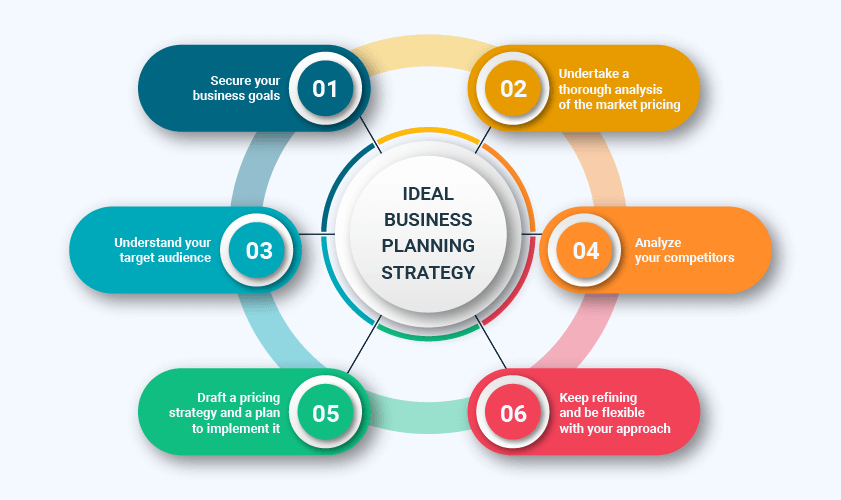

Establishing a winning pricing technique is important for maintaining competitive benefit and maximizing earnings in today's vibrant market atmosphere. A complete understanding of market characteristics, client habits, and price frameworks lays the foundation for enlightened rates choices. Additionally, assessing rival rates and constantly adapting your approach can improve your market placement. The intricacy of integrating these aspects commonly elevates questions about the most reliable technique. What details techniques can services use to guarantee their prices technique not just fulfills prompt needs but additionally places them for lasting success?

Understand Your Market

Recognizing your market is important for developing an effective prices strategy. An extensive market evaluation enables businesses to recognize consumer actions, choices, and regarded value of items or services. This understanding assists to develop affordable rates that lines up with what clients want to pay while making best use of success.

To successfully evaluate your market, begin by researching your target audience. In addition, assess your competitors by analyzing their prices structures, marketing methods, and market positioning.

Inevitably, a complete understanding of your market lays the foundation for a prices technique that not just attracts consumers yet also maintains your business in a competitive landscape. By aligning your prices with market dynamics, you can improve customer loyalty and drive lasting growth.

Analyze Your Expenses

To efficiently analyze your expenses, start by developing a breakdown of all expenditures linked with your product and services. This includes straight prices, such as manufacturing and delivery, in addition to indirect prices, like marketing and administrative expenses. Once you have a detailed review, compute your overall cost per system, which will work as a standard for your rates decisions.

In addition, consider the influence of economies of range; as manufacturing boosts, the per-unit expense may reduce. This insight can aid you recognize prospective prices techniques that permit affordable benefits. By thoroughly assessing your prices, you encourage your organization to establish costs that not just cover costs yet also align with your overall economic goals, ultimately contributing to lasting development and profitability.

Assess Consumer Worth

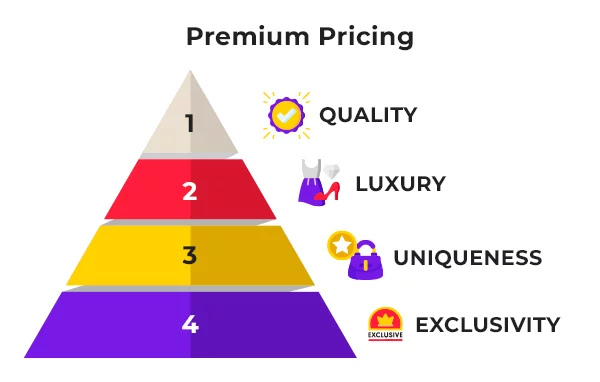

Client worth is an essential part in shaping your pricing technique, as it mirrors the regarded benefits that your services or product delivers to customers. Recognizing client worth needs a detailed evaluation of what your target market thinks about vital. This might include high quality, benefit, brand name online reputation, or one-of-a-kind features that identify your offering from others out there.

To assess consumer value successfully, engage with your consumers via studies, interviews, and responses types. These direct insights go can help recognize what aspects of your item resonate most with consumers and affect their buying choices. In addition, consider segmenting your customer base to tailor value assessments for various demographics or behavior patterns.

Eventually, a deep understanding of client value allows businesses to align their rates strategy with what clients are prepared to pay, promoting commitment and improving overall market competitiveness. This fundamental knowledge will offer as a crucial reference factor in establishing a reliable prices method tailored to your special organization context.

Evaluate Competitor Pricing

When creating a pricing strategy, assessing rival rates is important to guarantee your company continues to be competitive in the marketplace. Recognizing just how your rivals price their services or products provides important insights that can inform your very own pricing choices. Start by determining vital gamers in your sector and assessing their prices versions, consisting of discounts, bundling, and any type of promotional approaches they employ.

Next, compare the attributes and benefits of your offerings against those of your rivals. This assessment will assist you figure out whether you can justify a costs rate or if an extra competitive technique is needed. Take note of client responses and market trends that might influence rates dynamics, as these factors can change the competitive landscape.

Competitors may have differing prices approaches based on place or demographics, necessitating a customized strategy for your service. By constantly checking and reviewing competitor rates, you can make informed decisions that enhance your pricing method and overall market competitiveness.

Test and Change Strategy

Examining and readjusting your pricing strategy is critical for keeping competitiveness and maximizing success. As market characteristics develop, consumer preferences shift, and new rivals emerge, your prices must continue to be pertinent and efficient.

To begin, execute A/B screening by offering different costs to varied client segments or through distinctive sales channels. Evaluate the resulting go sales efficiency and customer feedback to recognize optimum prices points. Make use of logical devices to track vital metrics such as conversion prices, ordinary purchase values, and customer purchase prices.

Frequently get responses from your customer base relating to viewed value and rates (Pricing Strategy). This input can provide valuable understandings that assist changes

Finally, maintain an adaptable mindset; be prepared to pivot your method in response to the information you collect. By constantly checking and improving your rates method, you will certainly not just enhance your affordable edge yet likewise foster long-term client loyalty and success.

Conclusion

In verdict, establishing a winning prices technique requires a detailed understanding of the market, an in-depth analysis of prices, and an evaluation of customer worth. Examining rival prices enhances critical positioning, while recurring testing and adjustments make certain responsiveness to market dynamics. By incorporating these aspects, businesses can develop a pricing framework that maximizes profitability and aligns with consumer expectations, inevitably adding to sustained affordable advantage and long-term success in the market.

Customer worth is an important element in shaping your pricing approach, as it mirrors the perceived advantages that your item or service provides to consumers. Eventually, a deep understanding of customer value enables services to straighten their rates technique with what customers are eager to pay, fostering commitment and enhancing general market competitiveness.When developing a prices method, reviewing rival rates is essential to ensure your organization stays affordable in the market. By constantly examining and keeping an eye on rival pricing, you can make educated choices that boost your see this page rates technique and total market competition.

In final thought, establishing a winning prices strategy necessitates a comprehensive understanding of the market, a thorough evaluation of costs, and an analysis of customer value.